Which Cync® Product is Right for You?

Loan Origination

Optimize your loan origination process with best-in-class insights and integrations.

Asset-Based Lending

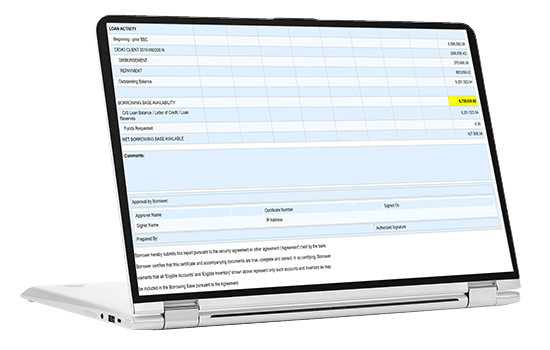

Securely automate your borrowing base certificate process with Cync ABL.

Client Portal

Provide borrowers with their own secure environment with real-time information.

Choose a Product That Meets Your Commercial Lending or Factoring Needs

I want to…

Cync Software’s Financial Analyzer is a cloud-based, relationship-driven application that enables lenders to streamline processes, automate financial spreading, and access quick cash flow analysis for faster, more accurate decision-making.

Cync Software’s Loan Origination System (LOS) is a cloud-based, relationship-driven application that enables lenders to streamline the entire loan process—from “know your customer” (KYC) to booking and closing. Cync LOS offers innovative features and an intuitive navigation for streamlining and automating the loan origination process, providing flexibility, saving time, and mitigating the risk of human error.

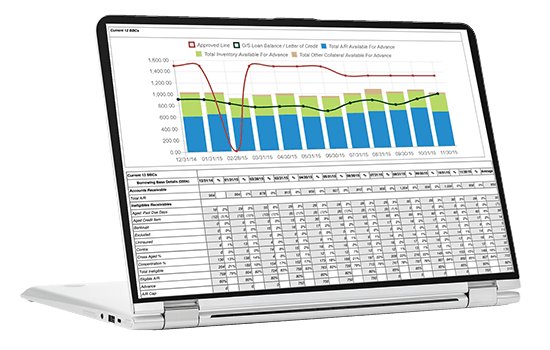

Cync Software’s Asset-Based Lending (ABL) application is designed to improve a lender’s ABL portfolio management and increase productivity through BBC automation. Cync ABL’s reporting, trending, and graphs provide complete control and analysis for asset-based lenders, enabling them to grow their commercial portfolio profitably, all the while minimizing risk and improving the borrower’s experience.

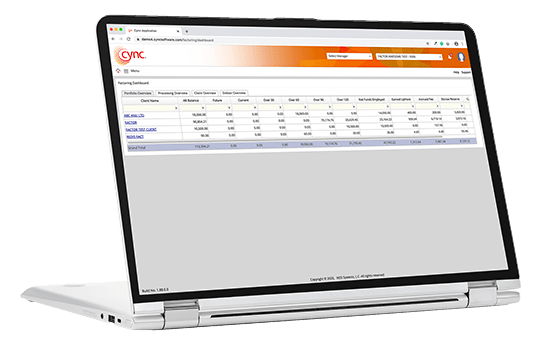

Cync Software’s Factoring solution saves lenders time and money by automating manual processes. Factoring offers the ability to monitor activity and critical data anytime, anywhere, and on any device, providing real-time updates for improved decision-making and helping reduce fraud and overall risk.

Cync Software’s Client Portal improves the borrower experience and delivers transparency to all parties involved by providing a secure environment where borrowers can view real-time account information, run reports, see availability, submit advance requests, upload invoices, add new debtors, and more. With the files already uploaded to the Cync Software solution by the client, lenders no longer need to download files locally to process them.

Cync Software’s Financial Analyzer creates a landing page for day-to-day operational activities, giving lenders a space to maintain contact information and easily access the other feature components specific to that entity while using a combination of machine learning and manual flexibility to build out the exact spreading template a user needs to most effectively analyze each unique borrower.

Cync Software’s Loan Origination System (LOS) allows lenders to add, manage, and pledge the collateral that will be used to secure a loan, grant and log exceptions as needed, and create and monitor relationship or loan-specific covenants and ticklers.

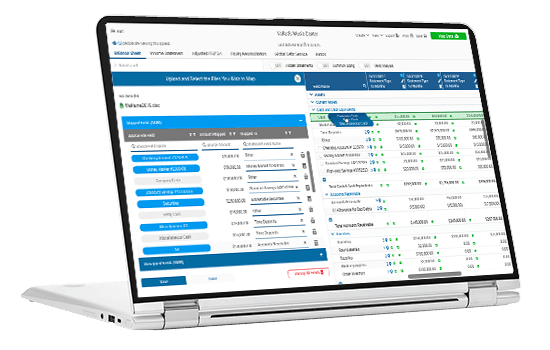

Cync Software’s Asset-Based Lending (ABL) allows lenders to efficiently and effectively make calculations based on the borrower’s collateral, which usually consists of AR, inventory, and equipment. The application is designed to improve the lenders’ ABL portfolio management and increase productivity through BBC automation, automatically calculating ineligibles by simply uploading a file to the application.

Cync Software’s Factoring covers the entire Portfolio Management process, which includes uploading and validating invoices, verification letter tracking, and calculating and recording advances, reserves, and fees. Cync Factoring supports cash batch entry, tracks reserve balance activity upon payment processing, and has export capabilities to accounting General Ledgers.

The Cync Software Client Portal allows clients to upload or manually enter invoices or cash receipts, verify image attachments, and submit requests while also giving them the ability to review, print, and export reports.