Join us at SFNet’s 78th Annual Convention | Mastering Disruption—Putting Capital to Work in the New Global Environment

Customer Success Stories

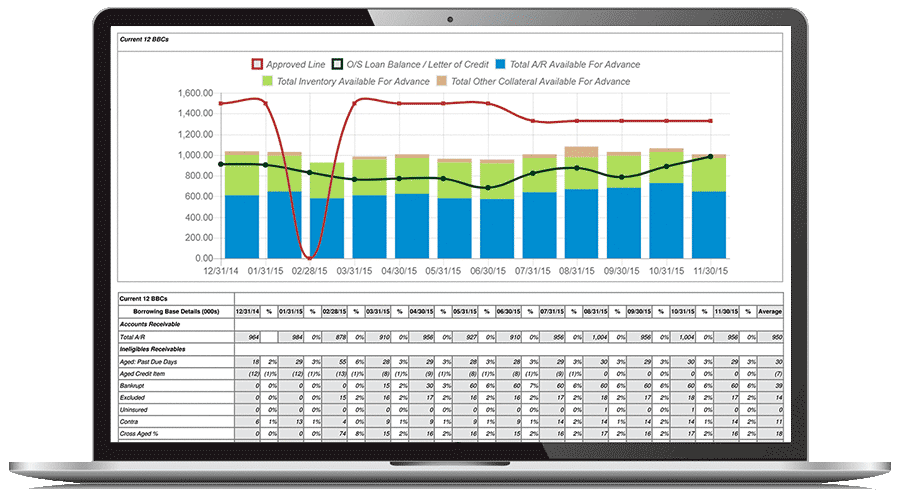

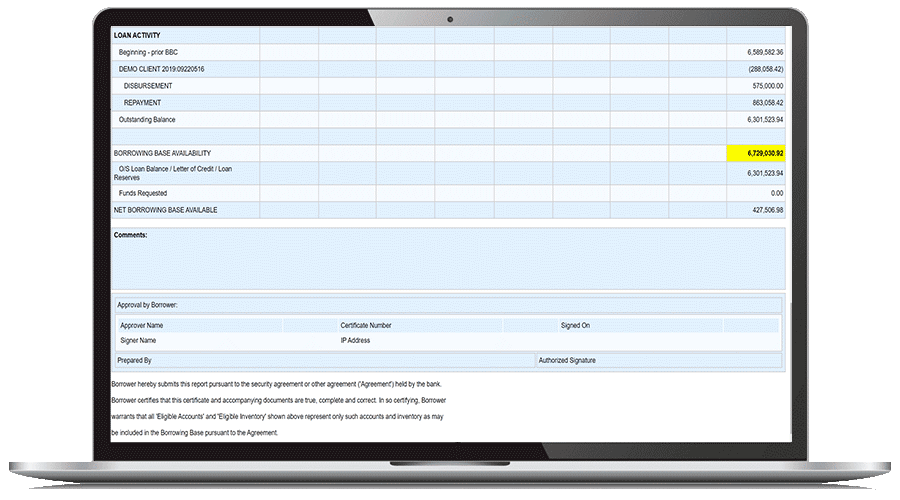

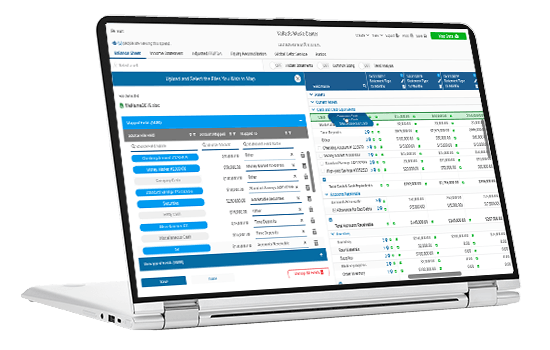

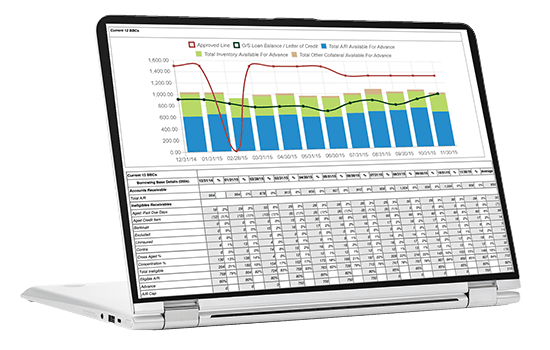

BBC Automation & Cost Reduction

The upload to the BBC calculation went from 4 hours manually per client to 18 minutes with Cync—this was a huge efficiency gain for us. Also, getting information through to clients has gone from 10 days per month for turn days down to 3—senior management has been very happy with these results.

– Errin Richardson, Columbia Bank

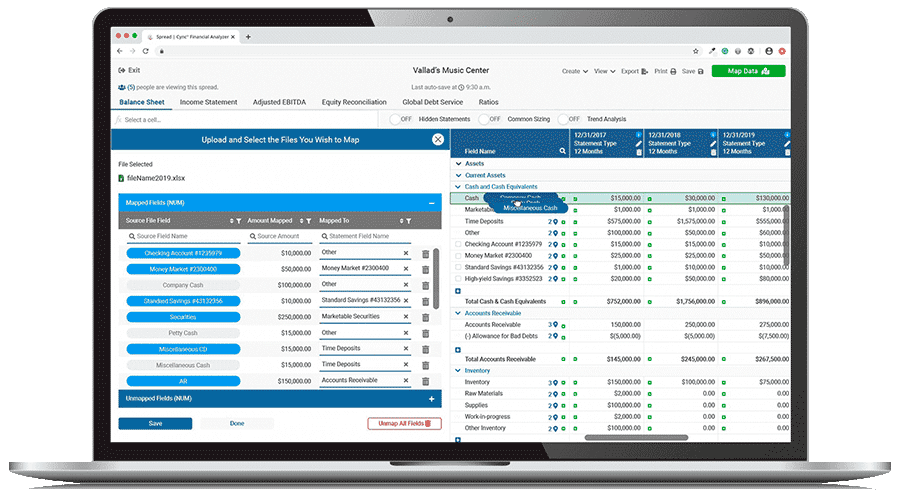

Streamlined Loan Processing

Before Cync Software, our loan processing was entirely manual and Excel-based. We needed a cloud-based solution that would reduce the potential for error, improve the user experience and provide the automation we needed. Cync Software really went above and beyond by allowing us to customize a solution to better fit our growing portfolio.

– Evan Henris, Parabilis

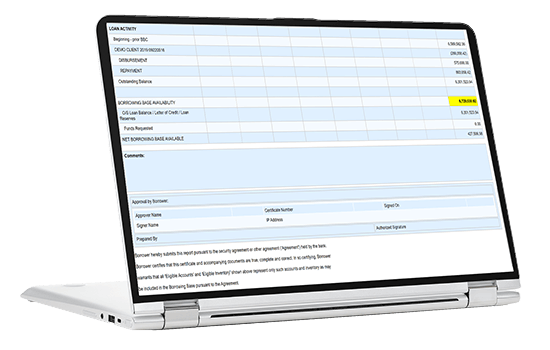

Loan Servicing

Cync created a customized solution for us, that reduced our costs from having an external vendor manage our loans to having it all in one application. We can service more loans with the same amount of staff.

– Jon Finley, CircleUp

Cloud-Based Products for Commercial Lending

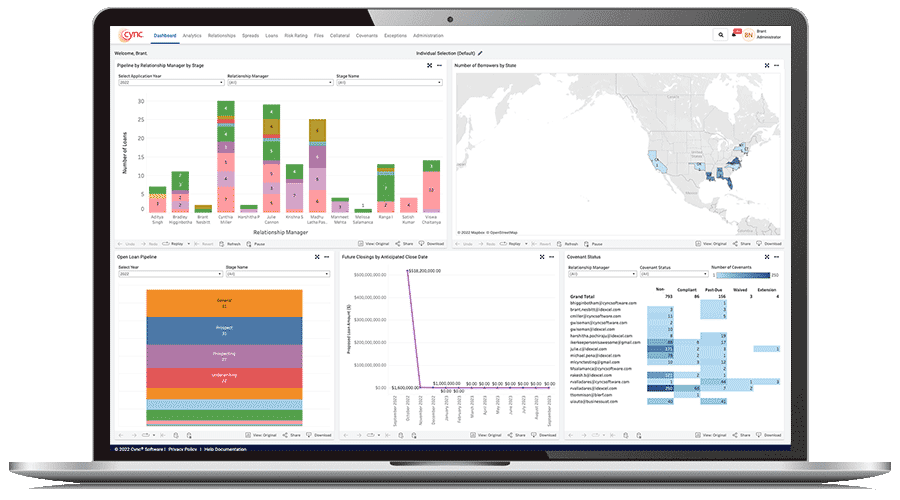

Cync LOS

Optimize your loan origination process with best-in-class insights and integrations.

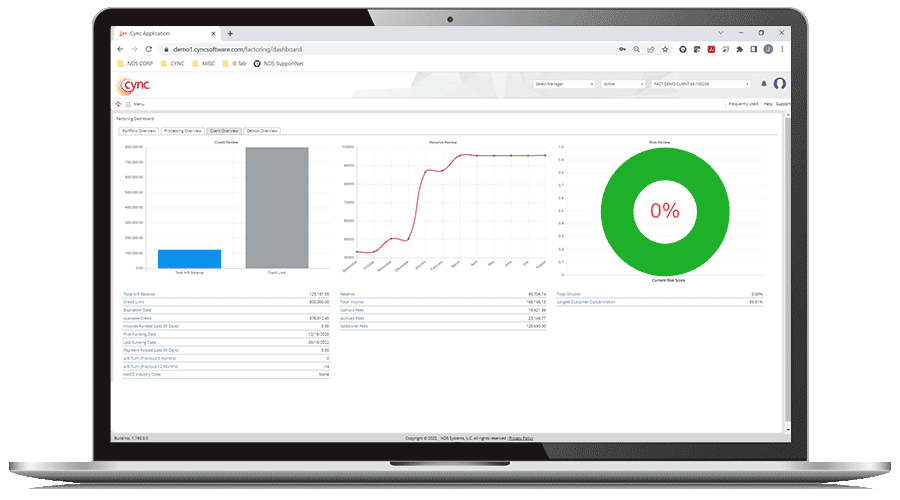

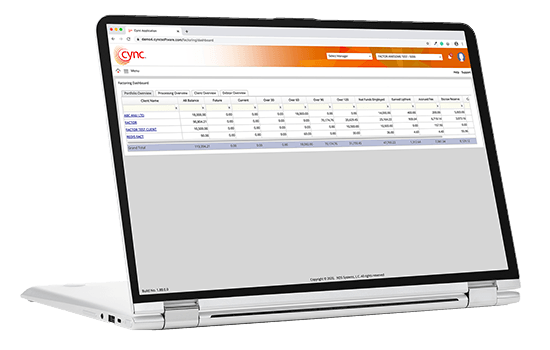

Cync Factoring

Create and assign fee schedules at the client level or to individual debtors.

Cync Client Portal

Provide borrowers with their own secure environment with real-time information.

Seamless Integrations for Custom Solutions That Meet Your Needs